UCC BDCI partners with the Development Bank of Jamaica, (DBJ) as a Business Development Organization (BDO) to provide advisory services to assist MSMEs in accessing critical business development services. Under this partnership, UCC BDCI main responsibilities will be to:

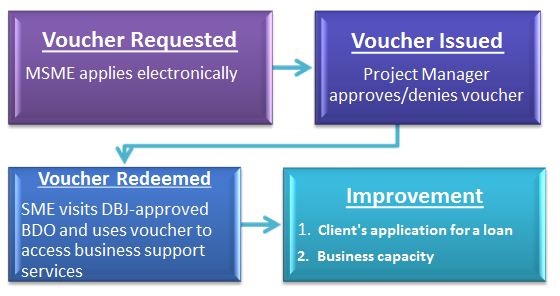

The partnership allows UCC to deliver business development services under DBJ’s Voucher for Technical Assistance (VTA) programme to improve the capacity and operations of Micro, Small, and Medium Enterprises (MSMEs). The aim of the programme is to assist MSMEs to access various business development services and support, thereby strengthening their capacity and positioning them to access financing and improve the efficiency of their operations.

The VTA program is a capacity-building program introduced by the DBJ in 2014 and provides grants to assist Micro, Small, and Medium-sized Enterprises (MSMEs) in closing management gaps and thereby improving their chances of securing financing at a DBJ’s Approved Financial Institutions (AFI). AFI’s include Commercial Banks, Merchant Banks, Credit Unions, and Micro Financing Institutions.

When an MSME applies for a loan from a financial institution and their application is denied due to significant gaps identified in their management and administrative capacity, they are issued a voucher by the financial institution which is redeemable at a Business Development Organization (BDO) such as UCC BDCI. The suite of Business Development services offered through BDCI will address the critical areas of deficiency of the business to improve its operations and the capacity to mobilize resources.

Vouchers are valued at up to $200,000 to cover the cost of the business development services we offer. The DBJ will finance up to 70% of the cost of each service or the value of the voucher, whichever is lower. MSMEs are responsible for paying the remaining 30% of the cost of the service received.

MSMEs which operate in the productive sectors such as agriculture, agro-processing, manufacturing, and mining; and those in emerging industries like animation and information technology, may receive vouchers in various denominations to be used to access business support services.

The Development Bank of Jamaica established the Voucher for Technical Assistance (VTA) programme in 2014, designed to assist Micro, Small and Medium-Sized Enterprises (MSMEs) in strengthening their managerial and administrative abilities to improve their credit eligibility.

Under the VTA, MSMEs that operate in the productive sectors may receive vouchers in various denominations to access business support services provided by accredited Business Development Organisations (BDOs).

Entrepreneurs who operate businesses in traditional industries as well as emerging industries qualify for assistance. Traditional industries are agriculture, agro-processing, tourism, energy, manufacturing, mining, and services, while emerging industries include animation and information technology.

Entrepreneurs or MSMEs who do not wish to access a loan but wish to improve their business operations, or prepare for other types of investment, may apply for a voucher online on the DBJ’s website. The Project Manager will assess applications and approve or deny based on the criteria set out in the programme documents.

It is important for the entrepreneur to be aware that the DBJ’s technical assistance should improve its ability to access funding and assist in maintaining a sustainable business operation. Therefore, the DBJ and its partners will monitor the beneficiaries after the assistance package is complete.

How the VTA Works:

It is important that applicants take note of the following: